For those considering a career in finance, the salary of a Financial Analyst is a critical factor to ponder.

In 2024, Financial Analysts in the United States can expect an average salary ranging between $52,000 to $90,000.

This range varies depending on location and experience level.

In regions like the UK and Ireland, compensation levels align similarly, reflecting regional economic factors and demand for financial expertise.

Financial Analysts play key roles in guiding businesses and individuals in financial decision-making.

Their skills are valued across multiple industries, influencing salary expectations globally.

For instance, in Australia, a Financial Analyst’s salary can range significantly based on market conditions and professional certifications.

Aspiring analysts may benefit from pursuing additional education and certifications, which can impact earning potential positively.

To maximize their earnings, Financial Analysts should consider the benefits of obtaining certifications, such as CFA or CPA.

Such qualifications can enhance career prospects and salary potential in competitive environments.

By exploring various industries and locations, analysts can identify opportunities that align with their career aspirations and financial goals.

Key Takeaways

- The average salary of a Financial Analyst varies by region and experience.

- Education and certification positively impact salary prospects.

- Employment growth in financial analysis offers diverse opportunities globally.

Understanding Financial Analyst Salaries

Financial analysts’ salaries vary significantly based on experience, location, and industry.

This section covers the determinants of salary, compares average salaries, and discusses salary trends and employment growth to provide a comprehensive understanding.

Determinants of Salary

Salary for financial analysts largely depends on factors such as experience, industry, and geographic location.

Typically, those with over 20 years of experience at prestigious firms can expect salaries as high as $400,700.

Entry-level analysts, however, often start with an average salary ranging from $50,000 to $60,000 per year.

The industry plays a crucial role as well; financial analysts in sectors like investment banking generally earn more compared to those in corporate finance.

Location impacts salary too, with analysts in major financial hubs such as New York earning significantly more than those in smaller cities.

Average Salary and Comparisons

The average financial analyst salary in the United States is around $67,855.

Some organizations report wide-ranging figures from $66,795 to $99,890 based on varying data sources.

In the United Kingdom, financial analysts earn an average of £35,000 to £45,000 annually, while in Ireland, the figure is approximately €45,000 to €55,000.

Meanwhile, in Australia, salaries range from AUD 60,000 to AUD 85,000.

These figures demonstrate the financial analyst salary range globally, indicating the importance of considering regional economic conditions and cost of living when evaluating these numbers.

Salary Trends and Employment Growth

There is a growing demand for financial analysts, contributing to stable employment growth in this field.

The longer professionals remain in the industry, the more they can earn, as knowledge and expertise typically translate into higher salaries.

Moreover, as companies increasingly rely on data-driven decision-making, the role of financial analysts has expanded, leading to diverse opportunities across various sectors.

Those looking to maximize their earning potential should consider the implications of specialized certifications and advanced degrees, which can further enhance their qualifications.

For a more detailed insight into current compensation trends, professionals can refer to a business analyst salary overview to understand the financial landscape and expectations within this field.

For instance, senior financial analysts earn about $96,423 annually.

Employment opportunities are expected to increase as more organizations seek to invest strategically.

This demand enhances job stability and possibly boosts salary offers over time.

Additionally, the increasing complexity of financial products also heightens the need for skilled analysts.

This trend underscores sustained optimism for salary growth in the industry.

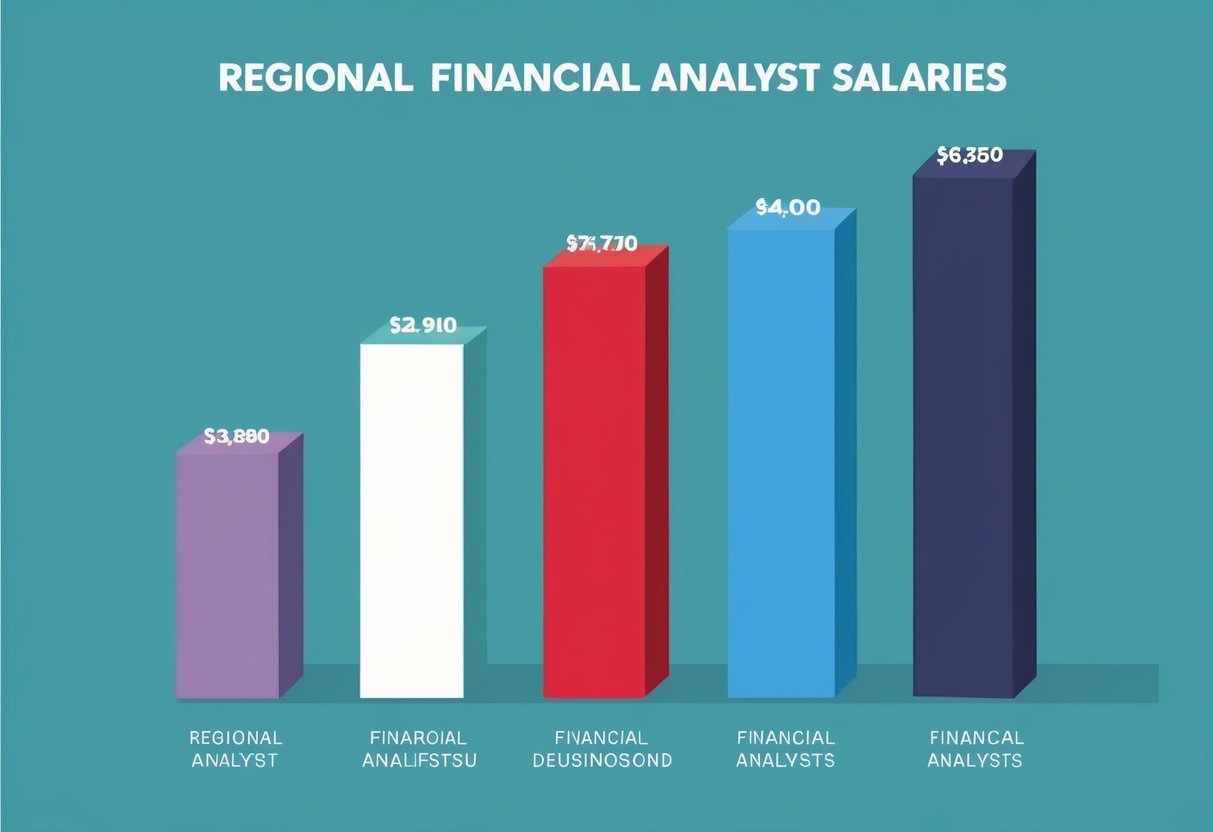

Regional Salary Variations

Regional salary variations for financial analysts can be significant.

In places like New York, analysts often enjoy higher salaries due to the cost of living and economic opportunities.

Meanwhile, Los Angeles also offers competitive salaries, reflecting its robust finance sector.

Financial Analyst Salaries in New York

In New York, financial analysts benefit from a thriving financial industry that includes investment banks, hedge funds, and asset management firms.

The median salary for financial analysts in New York is notably higher than the national average, often reaching around $75,103.

The typical range is from $68,402 to $83,003.

The city’s status as a global financial hub significantly impacts compensation rates.

A variety of factors influence these figures, including industry demand and the cost of living.

Analysts in New York can expect additional compensation through bonuses or other incentives, enhancing their total earnings.

This economic environment creates attractive opportunities for financial professionals seeking to maximize their earning potential.

Financial Analyst Salaries in Los Angeles

Los Angeles presents a diverse landscape with opportunities in entertainment, technology, and finance.

Analysts in Los Angeles have a median salary that competes with national averages, indicating a healthy job market.

The range often spans from mid to high figures, factoring in additional compensation like bonuses.

The city’s vibrant economy supports competitive salaries, attracting finance professionals keen on benefiting from varied sector opportunities.

Los Angeles continues to be an appealing destination for analysts seeking diverse career opportunities and a balanced cost of living.

Beyond the US, financial analysts in the UK, Ireland, and Australia also see differentiated pay influenced by regional economic conditions and industry demands.

While median salaries are comparable, local opportunities and cost of living greatly affect overall compensation.

Impact of Education and Certification on Salary

Education and certification significantly influence a financial analyst’s salary.

A bachelor’s degree lays the foundation, while advanced certifications can further enhance earning potential.

Understanding how educational achievements correlate with salary can guide career planning and development.

Bachelor’s Degree Influence

A bachelor’s degree is typically the minimum requirement for a financial analyst position.

It serves as the foundation for analytical skills and economic understanding.

Individuals holding a bachelor’s degree often see a significant starting salary increase compared to those without higher education, averaging around $55,000 annually in the United States.

In the UK and Ireland, starting salaries are often equivalent to £35,000 and €40,000, respectively.

Across regions like Australia, a bachelor’s degree can lead to salaries beginning at approximately AUD 75,000.

Degrees in finance, accounting, or economics are particularly beneficial, as they provide essential skills needed in financial analysis.

This foundational education is key to entering higher-paying roles or pursuing further certifications.

Advanced Certifications and Salary Boost

Certifications like Certified Investment Analyst, Certified Private Wealth Advisor, and Financial Risk Manager can substantially boost a financial analyst’s earning potential.

These credentials demonstrate expertise and dedication, often leading to higher salaries and job opportunities.

In the U.S., having certifications can result in earnings upwards of $120,000.

In the UK and Ireland, certified professionals might earn between £60,000 and €70,000.

In Australia, certification can increase salaries to around AUD 120,000.

These credentials emphasize specialized skills and comprehensive knowledge, which often translate into significant financial compensation.

Each certification requires specific education and experience levels, highlighting the importance of continual professional development in the field.

Financial Analyst Career Prospects

Financial analyst positions continue to expand, driven by a robust demand in financial services.

Job satisfaction is often high in this field, with opportunities for long-term career growth due to stable employment and competitive salaries.

Number of Jobs and Market Demand

The demand for financial analysts remains strong, with the U.S. Bureau of Labor Statistics projecting a 9% growth in employment from 2023 to 2033.

This increase is attributed to the expanding scope of financial services and a need to replace workers transferring to other occupations or entering retirement.

On average, around 30,700 job openings are expected each year due to this demand.

In other countries, similar trends are observed.

In the UK, Ireland, and Australia, financial analysts are experiencing robust market demand due to their critical role in navigating economic complexities.

Employment prospects are promising due to ongoing growth in global financial markets.

Job Satisfaction and Career Longevity

Financial analysts typically have high job satisfaction.

Many professionals value the analytical and strategic nature of their roles, contributing to high levels of engagement and low turnover.

Analysts also enjoy strong career longevity.

The financial industry’s steady growth partly contributes to this.

Analysts in these roles report enjoying varied and challenging tasks, contributing to their satisfaction.

Competitive salaries further enhance the appeal of this career.

In 2022, U.S. financial analysts had a median salary of $90,680.

Opportunities for higher earnings are also available based on experience and location.

In the UK, Ireland, and Australia, financial analysts can also expect competitive salaries, making the career attractive across different regions.